About Us

01

The business

Aesterix Group LLP's business activity involves trading and investing in financial markets, including stocks, commodities, cryptocurrencies, and other financial products, utilizing its proprietary capital derived from owner equity and loans. To mitigate borrowing risks in turbulent market conditions, Aesterix Group LLP plans to utilize option contracts for hedging and to grow a cash reserve.

02

Partners

Through astute investments and the expertise of highly skilled investment analysts, Aesterix Group LLP aims to generate returns that exceed its annual interest expenses, thereby ensuring sustainable growth.

03

Creditors

Aesterix Group LLP seeks to establish loan agreements with interest rates higher than those offered by banks on savings accounts for private individuals. Æsterix does not seek to make any public financial service offerings. Instead, strictly establishing loan agreements with private individuals on a case-by-case basis. This approach ensures steady growth and funding availability for Aesterix Group LLP as well as creditor satisfaction. Aesterix Group LLP is unable to offer any equity to non-partner entities or persons due to regulatory requirements.

Strategy

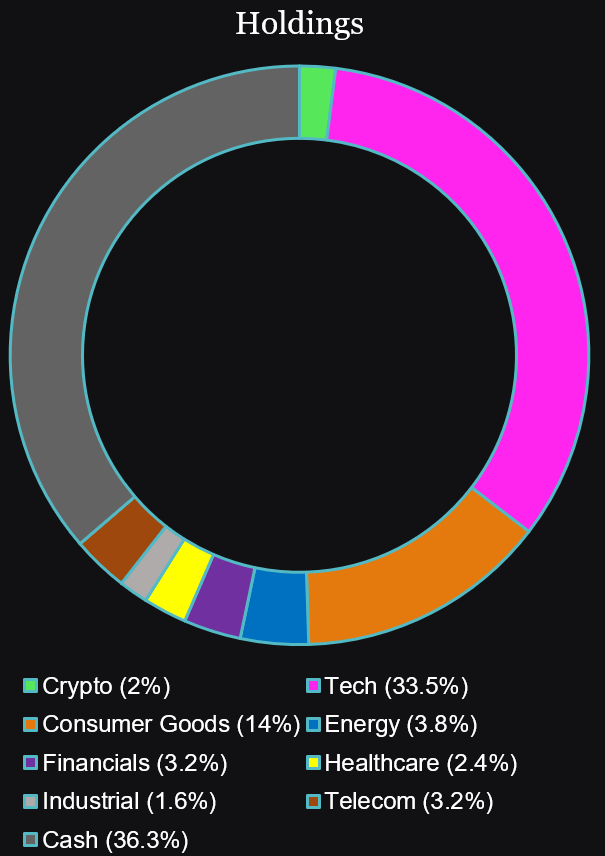

AESTERIX GROUP LLP business model revolves around investing its proprietary capital. Rather than adopting a more disconnected buy-and-hold strategy, Æsterix employs a strategy akin to swing trading to capitalize on ever-changing market dynamics.

This approach is facilitated through daily analysis and monitoring, combined with careful risk-adjusted margin utilization, thereby necessitating high cash holdings. Consequently, liquidity is a key aspect of Æsterix’s success. Increasing total assets through loans remains a central focus in the group’s business plan.

Aesterix Group LLP primarily engages in trading stock-related assets and other financial instruments, such as CFDs, ETFs, futures and options. Æsterix also intends to leverage the increasing capital concentrations in the Web 3 sphere and semi-conducters, leveraging cutting-edge AI and bot trading technologies to maximize returns and capitalize on market opportunities.

Our expertise includes crypto grid trading, focusing on major coins such as USDT, SOL, BTC, and ETH, while continually exploring new prospects in emerging cryptocurrencies. We actively engage with decentralized finance (DeFi) platforms to unlock additional value and are keenly investigating the potential of NFTs to further diversify and enhance our investment strategies.

This revision highlights the firm’s advanced trading techniques and commitment to exploring innovative financial opportunities.

Funding

To adhere to Æsterix Group’s liquidity requirements, in addition to partner contributions, Æsterix is willing to establish term loans agreements with private individuals. Aesterix Group LLP does not offer any equity, investment products or services to creditors or any non-partner entities or persons. Additionally, Æsterix does not seek to make any public financial service offerings.

Æsterix aims to attract creditors by offering favourable conditions for each of its creditors; therefore, the loan terms will be assessed on a case-by-case basis. The terms will depend on the amount the creditor is willing to loan, thereby mitigating Æsterix’s risk of liquidation.

Furthermore, the interest rate structure unique to Æsterix Group involves both fixed and variable components. Loans will be sought at a fixed interest rate, comparable to the current bank savings rate, with an additional variable interest rate. The variable rate, which will be strictly positive, will be determined by the management of Aesterix Group LLP at each year-end and paid out to creditors. This system mitigates the risk of liquidation for the enterprise, while making it possible for Æsterix to establish loans agreements with private individuals by agreeing to higher total interest rate than the bank savings rate.

Risk Mitigation Overview

- Building a Cash Reserve: Actively accumulating a cash reserve to ensure liquidity and prevent insolvency during economic downturns.

- Limiting Volatile Assets: Limiting exposure to volatile assets like cryptocurrencies to a maximum of 15% of our portfolio to minimize potential losses.

- Structured Loan Repayments: Structuring loan repayments with varying sizes and dates to ensure balanced and manageable repayment schedules, reducing cash flow strain.

- Variable Interest Rates: Using variable interest rate components in financing to adjust to economic changes and limit insolvency risks during lower performance periods.

Structure

Why choose LLP?

Æsterix Group does not intend to engage in crowd funding or issue shares. Registering as LLP allows easy changes to ownership structure to accommodate new partners. Additionally there are tax advantages, as an LLP is not subject to corporate taxation under UK law. Lastly, there are fewer bureaucratic requirements, thus resulting in more ease of doing business.

We'd Love To Hear From You

contact us

Get In touch

+44 7746-459-365

[email protected]

[email protected]

Contact Hours

Mon- Fri: 9am- 8pm

Saturday: 10am-4pm

Want to talk to us?

AESTERIX GROUP LLP

© 2024 All Rights Reserved.